Speculations abound over the robust stance of the US dollar continuing. This is largely due to expectations for potential interest rate reductions by the Federal Reserve and possible changes to monetary policy. Despite uncertainties, the outlook remains optimistic for a tough performance by the dollar.

The US dollar’s strength remains resilient despite changes in the global economic climate. Withstanding volatile market forces, it consistently demonstrates the economic strength and stability of the United States.

Analysts forecast that the Japanese Yen will retain its position as the preferred carry currency. This is mainly due to Japan’s consistently low-interest rates which bolsters its appeal to investors and Forex traders. The Yen’s status as a safe haven is expected to strengthen further amid ongoing global economic uncertainties.

The International Organization of Securities Commissions (IOSCO) has introduced a set of guidelines designed to offset risks associated with different operational practices across trading platforms.

Dollar’s resilience amidst interest rate uncertainties

The aim is to create global standards for secure and ethical trading. This is a crucial step towards establishing a robust, resilient, and transparent global financial system.

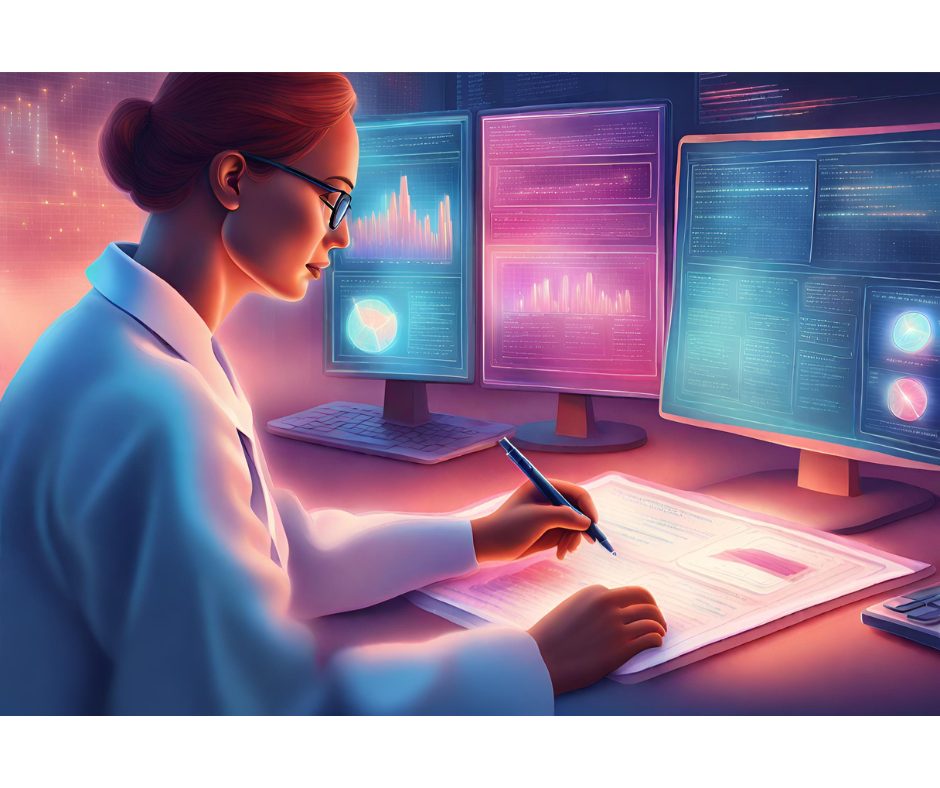

These economic projections and insights have been gathered by financial experts Sarupya Ganguly, Pranoy Krishna, and Purujit Arun, under the editorial supervision of Paul Simao. The team utilizes various econometric tools and methodologies to provide the most accurate predictions.

Ganguly, noted for her expertise in econometric modeling, provides depth in statistical analysis. Krishna brings to the table his knowledge of international financial markets and fiscal policy, while Arun specializes in market trends and patterns. Their analysis is meticulously reviewed by Simao, an experienced financial editor.

In light of potential substantial shifts in the global market, individuals working in finance and trading are encouraged to stay educated and exercise caution. By carefully managing risk, consistently monitoring reliable resources, and understanding the dynamics of fluctuating market conditions, professionals can be better prepared to navigate periods of economic volatility.

Understanding geopolitics is also beneficial as the political climate often impacts the global financial market. The secret to success in these challenging conditions lies in diversification, avoiding impulsive decisions, and staying informed.