Do you want to get familiar with FinTech industry trends? If yes, go through this article to get familiar with the top 5 trends in FinTech that will make sure to predict things the best way for you.

For those of you who are not familiar, FinTech is an overall utterance for transformations that are based on technology itself. In 2022, FinTech financing has significantly decreased, to its lowest in the previous five quarters and down 39% from the high in 2021.

Moreover, if you want to make sure that you don’t have to go through any consequences, make sure to keep an eye on FinTech innovations and trends in order to stay updated.

Image Source: digipay.guru

FinTech is dynamic in nature, even when we withdraw money from ATMs on a day-to-day basis, we can understand/know that it changed somehow from yesterday. According to The Salt Lake Tribune FinTech is growing rapidly day by day due to the introduction of amazing technologies.

The FinTech sector itself was able to gain $21.5 billion globally. So, if you want to be part of FinTech developments, getting familiar with FinTech trends is a must.

We will definitely get into FinTech ideas in detail, but before that let’s get familiar with its importance in more information.

Importance of FinTech Industry Trends

If you want to grow in the FinTech industry, getting familiar with Fintech technologies, data, innovations, and developments is a must.

In order to stand out from your competitors and earn more let’s get to know about the significance of innovations of FinTech so we can implement it in our day-to-day work.

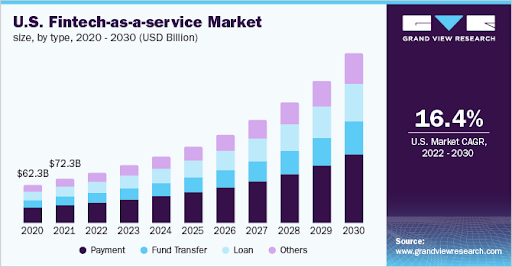

Image Source: Grand View Research

- Keeps up the user with the most recent market trends along with the knowledge to use and get adapted to the latest technologies.

- Helps different kinds of companies to inspect and investigate the different improvements in capacity, threat management, cost evaluation, expenditure management, and much more.

- Enhances the ability to withstand the expectation of customers through analyzing and estimation skills.

- Enables building amazing financial management services for overall economic development.

- Proper application of FinTech trends along with a top essay writing service will help you to note out the significant ways to manage more savings.

- Decrease the cost of an overall product by increasing the speed of overall transactions.

Trends in FinTech to Watch in 2023

1. Artificial Intelligence Along with Smarter Banking

Image Source: Technology Record

Chatbots are increasing day by day due to their efficiency. Researchers predict that in the upcoming days, it will grow ten times more as it is something that has been proven very useful.

Almost 93% of customers are easily understood as they want their banking services in the present and upcoming days as they desire. Moreover, due to this positive impact, even the FinTech industry is trying to adopt the latest AI and smart banking.

Both Artificial Intelligence and Smart Banking are growing and evolving. Moreover, it has become an important aspect of FinTech as customers prefer them due to its convenience.

2. Green Finance

The prime motive of Green Finance is to make sure that there is a better outcome/result through different environment-friendly activities. It not only deals with the outcome but also deals with the overall goods, services, and infrastructures.

Everyone can grow their financial output from all private, public as well as non-profit organizations in an easy and convenient way. Not only this, but it also covers a broader aspect in general. This is the development as well as sustainable development priorities accordingly.

It has been tracked since the 1970s and came into the business in 2015 and has been increasing rapidly throughout the world due to its positive aspect as well as its amazing impact in FinTech as well as another sector.

Hence, if you want to get familiar with FinTech Trends then Green Finance is probably one of the best tips due to its increasing demand as well as its amazing nature.

3. Digital-only Banking is Emerging

To those of you who have heard the term digital-only banking for the first time, let’s know what it is first of all. Digital-only banking means banking done through different digital platforms like mobile phones and/or tablet devices.

All the customers and users are busy these days. So, digital-only banking is suitable for almost every user as they don’t need to visit the bank physically. All they need to do is press a couple of buttons and add pins and the work is done just within a couple of seconds.

Moreover, contactless Mastercard and P2P services provide transactions without any extra charge and amazing accessibility. Not only that, you can exchange cryptocurrency, Ethereum, Bitcoin, and much more in the world of finance within just a blink of an eye.

One of the best parts is that it provides accounts for the payment procedure. The payment account is generally connected with the integrated debit card which can be accessed through your smartphone with ease.

4. Boosting Up the Regulation of Your FinTech

In today’s era, each and everyone needs to understand that there is a certain way a topic will peruse the overall ownership of the relevant and necessary data. The questions and answer to the question are provided at their own pace and way.

At this time, the regulation of the financial sector needs to be updated and uptime as it is one of the most developing industries throughout the world. One mistake and there will be plenty of people to criticize it.

Hence along with proper regulation, the officials will gain an overall impact on the government side. This will appear to be fruitful in the future aspect. Along with regulation, one must understand that security is equally and foremost important as well.

There should be the placement of all the necessary actions to improve the overall aspect of regulation along with security.

5. Super Apps with Amazing Powers

Super Apps are ever growing since the early couple of years. It will for sure continue to grow even more.

The main reason for Super Apps to grow is that the customers, users, clients, and so on prefer to manage their finance on their own. There is no better way to manage things or works using super apps which are amazingly functional, complete, and include many more amazing powers.

Wrapping Up:

This is the end of our article ‘Top 5 FinTech Trends to Keep an Eye on in 2023’. We hope this article helped you to gain a clear view of the most important trends in FinTech ideas.

You can learn about all these trends. Then, use any one of them or the one that is most suitable as per the context and time. Help our FinTech grow with these amazing trends and ideas!

If you are familiar with the FinTech Trends, feel free to share them with us in the comments section below. This way our readers and FinTech beginners will be able to gain even more ideas about this subject matter.

If you have any kind of queries, or confusion regarding this article, do let us know. We will be happy to help you throughout!

Learn FinTech trends and stand out from your competitors!