It’s certainly not a news flash that huge sporting events such as the World Cup and the Olympics attract throngs of visitors. Estimates for the 2014 FIFA World Cup in Brazil are somewhere in the neighborhood of 500,000 to 600,000 tourists from around the world, who are expected to generate somewhere around $3 billion in financial transactions.

The downside? “Those attending these events have a high risk of getting skimmed at an ATM or point-of-sale terminal,” warns Seth Ruden, a senior fraud consultant at payment processor ACI Worldwide.

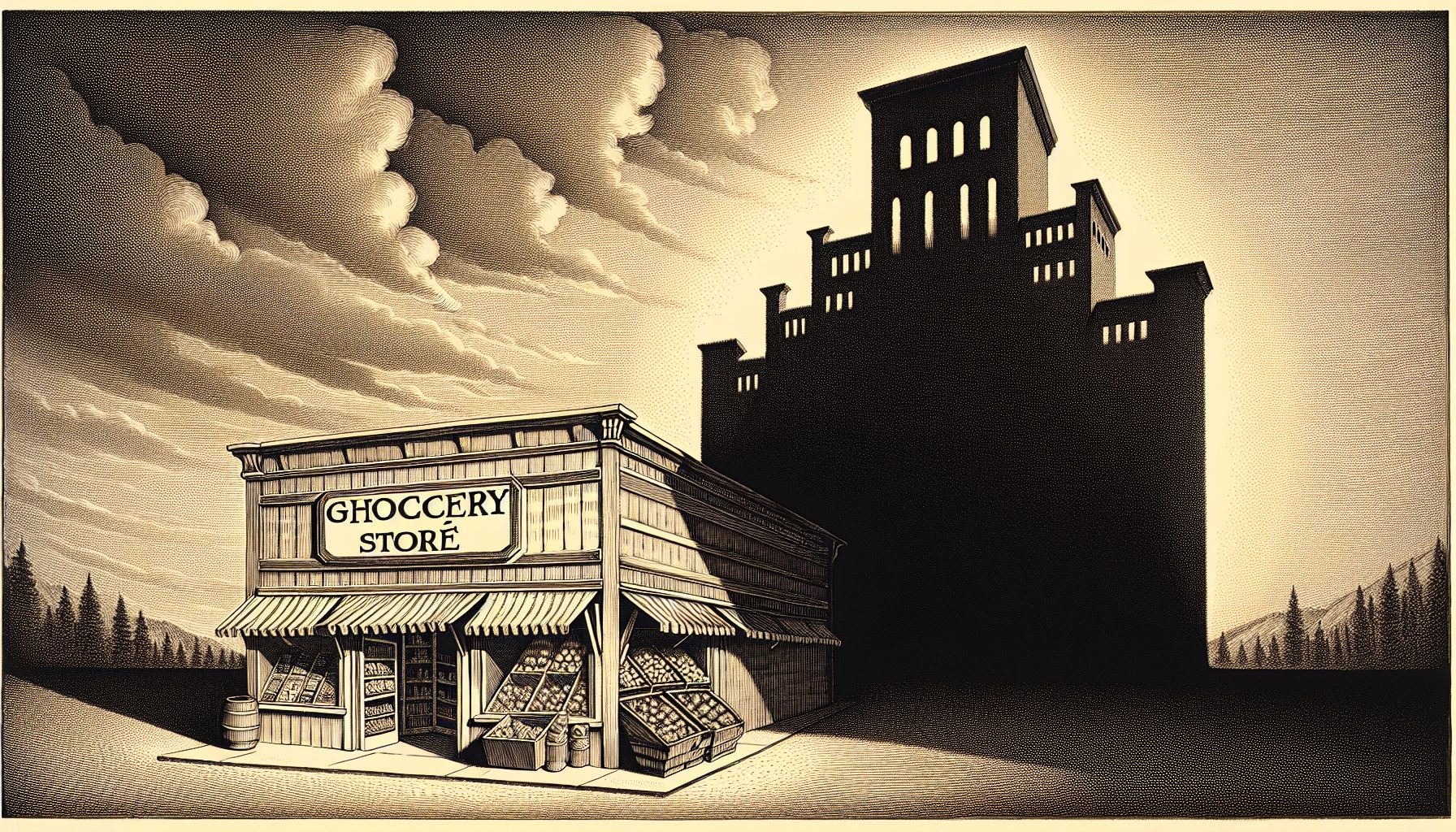

There are some lessons learned from the 2010 World Cup in South Africa and other similar events. Thieves are adept at modifying ATMs, and they are especially likely to do so in high-traffic areas, including hotels. But these criminals are also active in modifying gas pumps and finding store employees who will follow a valid sale with a second unauthorized swipe on a portable device that captures the card data from the magnetic stripe.

Although chip and PIN (personal identification number) cards, which hold the data on a more secure RFID chip, help reduce the risk, Ruden points out that any card with a magnetic stripe is a potential risk. Unfortunately, virtually all chip cards in the United States still contain a magnetic stripe because the adoption rate for the technology has lagged behind the rest of the world.

But that’s not the only problem: A U.S. Secret Service brief also warns that crooks may use covert cameras to capture a cardholder’s PIN.

ACI Worldwide’s 2014 Global Fraud Report found that 30 percent of Brazilians experienced card fraud in the last five years—the seventh highest rate of 20 large nations. As somewhere around 180,000 U.S. citizens are descending on Brazil with older magnetic stripe cards, fraud will almost certainly spike.

Ruden acknowledges that banks and other institutions are becoming savvier about spotting tampering and have introduced algorithms and other systems to detect fraud. However, he adds, it’s next to impossible to prevent fraud with current technology.

Consequently, it’s important to avoid kiosk ATMs and smaller units that aren’t clearly labeled with a bank name. It’s also wise to look for overlays and modifications, including things like a pencil holder that has a small bulb sticking out of the bottom. That could be a sign of a camera focused on the PIN pad.

In addition, Ruden recommends that a person using an ATM enter the wrong PIN the first time. If an error message does not appear, there’s an extremely high likelihood that a skimming device is being used.

Other precautions include using a VPN for any banking or sensitive business transactions taking place online; avoiding a public WiFi network; steering clear of public computers; and setting up fraud warnings and alerts that banks offer via email or text message. He also suggests carrying a second or third credit card.

“Unfortunately, ATM and other types of fraud are very easy and quick to monetize,” he warns. “In many cases, there is relatively low risk to criminals who use skimming and other systems.”