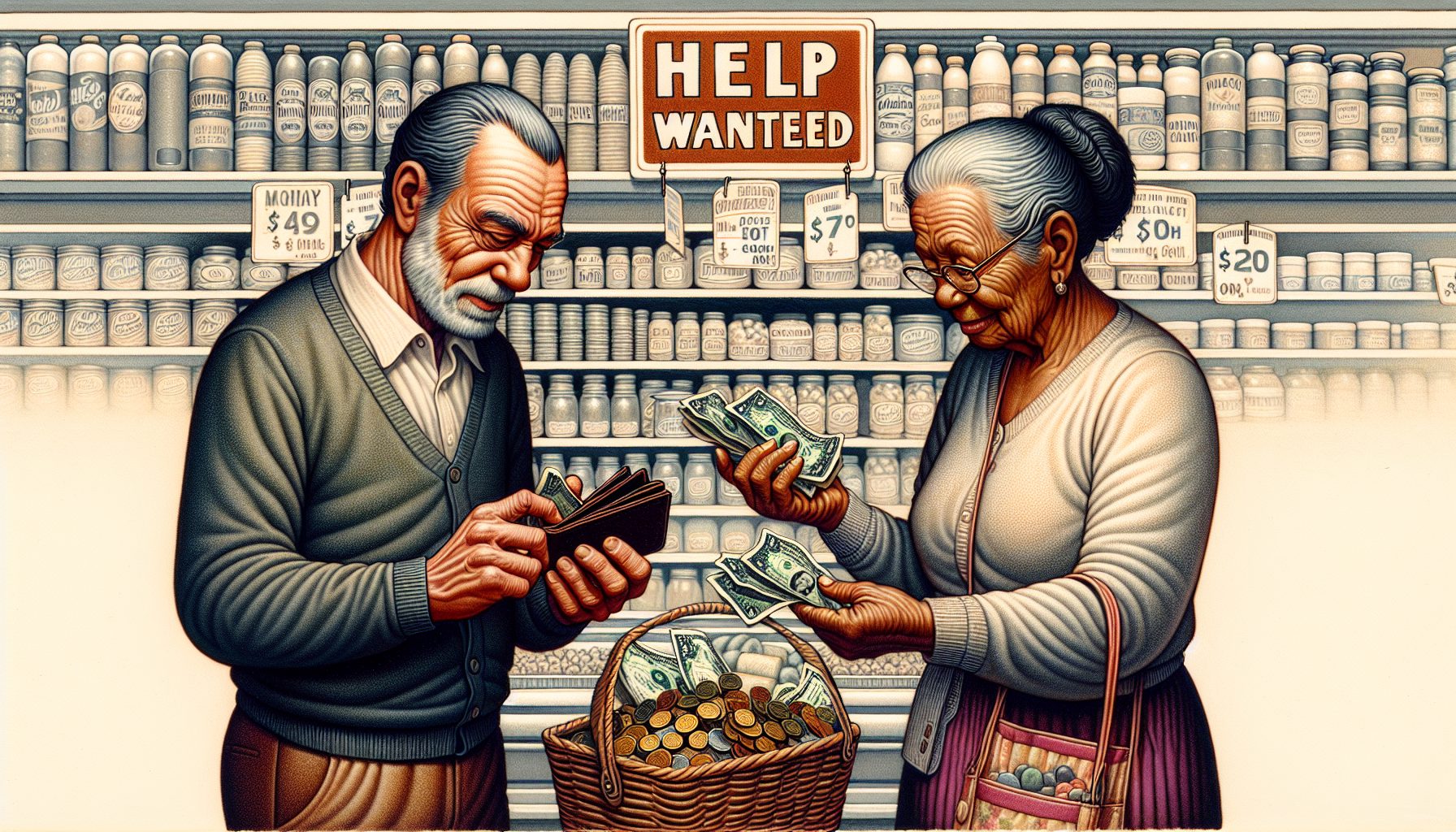

NEW YORK (Reuters) – Consumer sentiment dropped to a16-year low in February, hitting levels that usually sound thealarm bells of recession, on worries about declining incomesand rising unemployment, a survey showed on Friday.

Adding to the grim view, consumers’ expectations for thefuture also hit a 16-year low while worries about their abilityto makes ends meet and the overall economy were as bad as theyhave been in decades, the Reuters/University of MichiganSurveys of Consumers said.

The Reuters/University of Michigan Surveys of Consumerssaid its main index of consumer sentiment fell to a 16-year lowof 70.8 in February from 78.4 in January.

This was the final reading for February and was the lowestsince February 1992. It was up slightly from the preliminaryFebruary result reported earlier in the month of 69.6, whichalso would have been the lowest reading since February 1992.

"Consumer confidence remained at the same low level thatwas recorded during the recession periods of the mid-1970s, theearly 1980s and the early 1990s," the Reuters/University ofMichigan Surveys of Consumers said in a statement.

"The minuscule gain from the mid-month reading did notalter the basic fact that the extent of the recent decline hasconsistently been associated with a subsequent recessionperiod," it added.

Wall Street economists had expected a reading of 70.0,according to a Reuters poll. The 57 estimates ranged from 67.8to 78.0.

The Index of consumer expectations dived to 62.4 — alsoits lowest in 16 years — from 68.1 at the end of January.

"Expectations for personal finances as well as for theentire economy are now as pessimistic as any time during thepast quarter century," they said in a statement.

The index of current economic conditions also fell to a16-year low of 83.8 in February from 94.4 in January.

One-year inflation expectations jumped to 3.6 percent from3.4 percent in January. Five-year inflation expectationsremained steady at 3.0 percent.

(Reporting by Burton Frierson; Editing by James Dalgleish)

? Reuters 2008 All rights reserved